Financial intelligence – what does that mean to you?

Do you know your finances intimately?

More importantly, would you like less financial stress?

Too often practice owners simply rely on what their accountant tells them and keep an eye on the bank balance. They don’t develop their own financial intelligence.

They evaluate the past by reviewing their finances at the end of the financial year. They reflect on what might have been.

And that’s fine, but it’s only part of the picture.

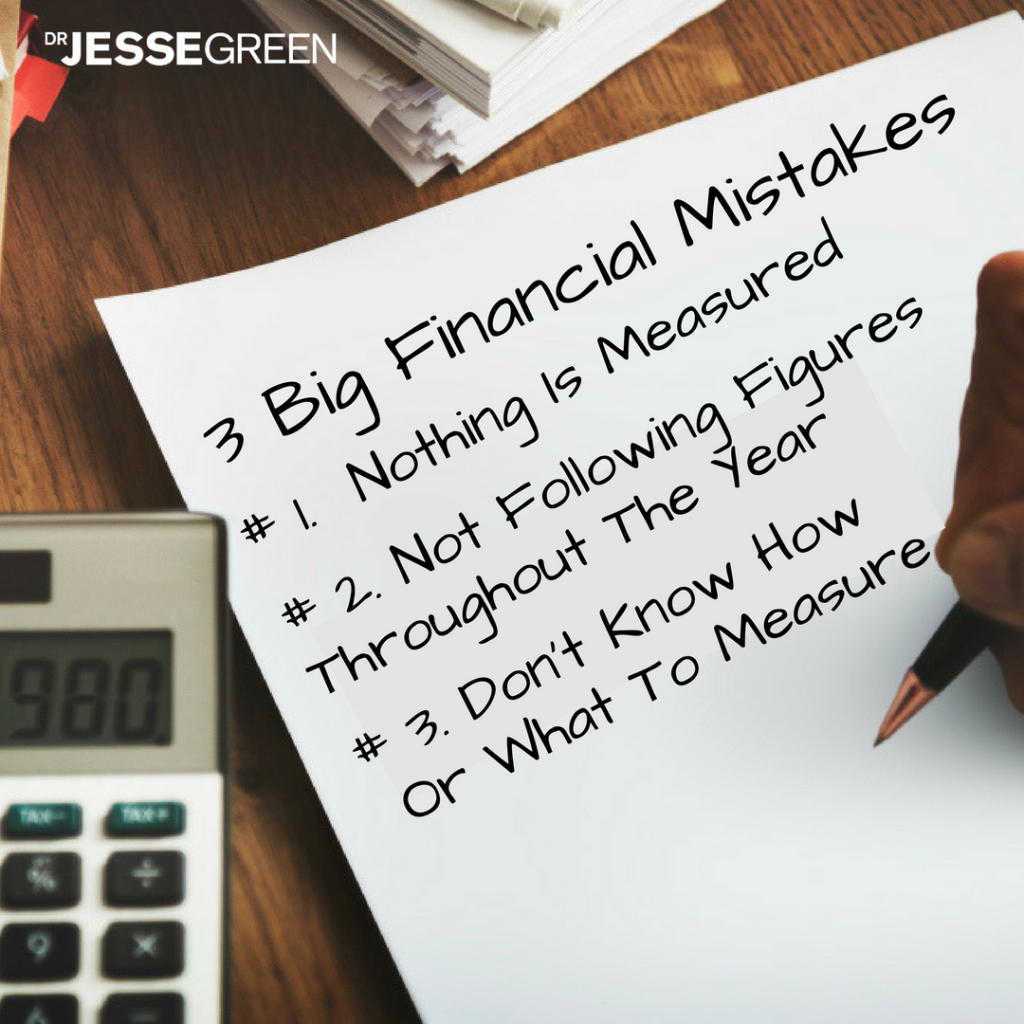

Because there are three key things they’re not doing. Here are the common financial mistakes business owners make with their finances.

Mistake #1: Nothing Is Measured

The reason nothing is measured usually falls down to one of two reasons:

1. Ignorance. That is simply because no one teaches dentists how to be business owners or educates them on finance.

2. Pain. Sometimes dentists find it too painful to look at their numbers, particularly if their business is not performing as they had hoped.

Mistake #2: Not Following Figures Throughout The Year

Many dental practice owners only look at their financial accounts at the end of the year, and by then it’s too late to make changes.

Mistake #3: Not Knowing How Or What To Measure

In some cases, they measure the wrong components because they just don’t know what drives their practice.

Business owners who are making these mistakes are not really mastering their cash flow. They’re not making intelligent decisions or establishing a financial rhythm.

You see, a true business owner is proactive in their approach. (Click to Tweet) They have a process for gathering the relevant data, analysing it, planning, forecasting the year ahead and tracking their progress

In short, they set plans in place to improve themselves or their performance for the following year.

So how exactly do you do that?

Well, there are five key steps to becoming financially intelligent.

1. Set A Goal

All dental practice owners who successfully scale their businesses first set a goal. This goal will be based on your five-year, three-year and 12-month targets.

The categories of these goals typically revolve around revenue, ideal lifestyle numbers and time-based at work.

2. Create A Financial Forecast

A financial forecast, or plan, acts as the roadmap from where you are now to where you want to be.

On that journey, it’s important to understand what milestones you need to meet, so you know when you’re on course or if you’ve become lost.

3. Determine What To Measure And When

For each practice, there will be a set of key drivers that dictate performance. Look at what you need to measure and what metrics you need to track on a daily, weekly, monthly, quarterly and annual basis.

Do this to establish your financial rhythm and embed this into the culture of your practice.

4. Maximise Revenue

There are only three ways to maximise revenue for your practice:

b. Increase the average amount each patient spends

c. Increase the frequency of transactions

5. Maximise Your Cash Flow

There are six steps when it comes to maximising your cash flow. They are:

a. Maximise your revenue (as above).

b. Decrease the cost of goods sold.

c. Decrease operating expenses.

d. Get in any monies owed quickly.

e. Push out your payables as far as possible.

f. Reduce your inventory or work-in-progress costs. If work is underway, make sure it’s completed promptly, and the money is collected.

Invest Your Time Wisely

By taking the time to develop your financial intelligence, you will begin to know your business intimately – inside and out.

You will understand what’s happening on any given day and make great decisions based on real-time data.

You’ll be able to change your course appropriately and quickly in response to certain activities that aren’t working.

This post is based on an extract from How To Build A High Performance Dental Practice by Dr Jesse Green. Download your free copy of the full report here.